Why Choose When Re:Form School Insurance Training Gives You Access To ALL COURSES???

All access Insurance training geared to make you the best professional possible for just

$150 a month or less!

What's Included?

Welcome to the Insurance Industry

Commercial Crime Insurance

Installation Coverage Policy

Workers Compensation and Employers Liability Policy

Commercial Auto Policy

“Tom’s training and mentorship helped propel my career forward. After working with him, I’ve been able to start my own agency and continue to see growth.” – Chanda G.

Business Owners Policy

Business and Personal Property Policy

Builders Risk Insurance

Commercial General Liability

“Tom is able to step into the shoes of his audience. His flexible training style helps students better process the material.” – Erik B.

Commercial Umbrella and Excess Liability Policies

Contractors Equipment Policy

Personal Auto Policy

Workers Compensation and Employers Liability Insurance

“Tom really has a knack for making the subject matter easy to understand. I’ve learned so much from him early in my career that I still use today.” – Kari S.

Owner/Occupied Homeowners Insurance

HO 3

HO 4 Renters Policy

HO 8

HO 6 Condo Owners Policy

Making The Case For Life Insurance

Term Life Insurance

This course will cover the basics of term insurance, how premiums are calculated (and change), and provide an in depth look at the types as well as the common riders attached to term life insurance policies.

Group Term Life Insurance

You will even learn the tax advantages that make this a popular employee benefit.

Group Health Insurance

Group Insurance health plans provide coverage to a group of members, usually comprised of company employees or members of an organization. Group health members usually receive insurance at a reduced cost because the insurer’s risk is spread across a group of policyholders.

In this course, you will learn the technical jargon of health insurance, the tax and other benefits of a group health plan, and the main types of insurance coverage offered in group health plans.

Group Disability Insurance

Group disability income insurance is a popular employee benefit that can be easily added to an employer’s total compensation package. Unfortunately, it isn’t necessarily easily understood.

This course will teach you all of the “moving parts” of disability income insurance available for the group market.

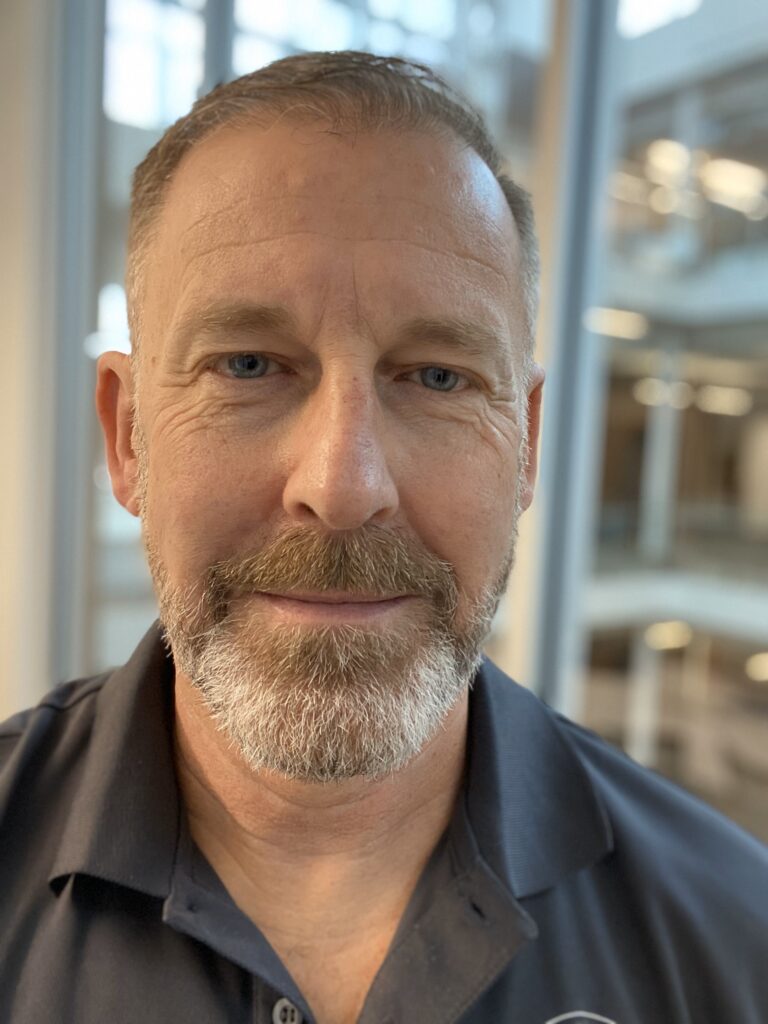

Meet Your Instructor

Tom Faulconer

Professor Tom Faulconer is a two-time award winning professor who teaches in Butler University's Davey School of Risk Management and Insurance at both the undergraduate and graduate level. He is an attorney, Certified Financial Planner(r), CPCU, CLU, ChFC, and CFP. In his long insurance career, he has served as Advanced Sales Counsel, Director of Agent and Field Training, and Senior Vice President of Marketing and CMO for a well-known insurance company.

Tom's superpower in life is taking the complex and making it simple!

Propel Your Career Today With Re:Form School

Finally, engaging, successful, practical insurance training created by an industry veteran and award-winning risk management professor.