Suggested Curriculum

Unsure where to start? Choose one of our suggested curriculum paths.

Personal Lines Curriculum

Welcome to the Insurance Industry

In this course you will learn the basics of the insurance industry, how you fit in, some important terminology, and quite a bit about insurance policies in general. This knowledge will make you more productive faster and a valuable asset in your organization and anywhere in the fast-growing insurance industry.

Personal Auto Policy

The Personal Auto Policy, or PAP, is the core of many property and casualty insurance agents’ books of business. Even multi-line agents often “lead” with the PAP in hopes of converting other lines of business as the client relationship develops.

ISO Owner/Occupied Homeowners Policies (includes HO 1, HO 2, HO 3, HO 5, and HO 8)

Dive deep into the wide assortment of homeowners policies and all of the best practices.

HO 4 (Renters Insurance)

The ISO HO 4 policy is for tenants protecting primarily the contents only.

HO 8 (Condo Insurance)

The ISO HO 8 policy is designed for use with older or unique homes. Coverage is more limited than other HO policy forms.

Small Business Curriculum

Welcome to the Insurance Industry

In this course you will learn the basics of the insurance industry, how you fit in, some important terminology, and quite a bit about insurance policies in general. This knowledge will make you more productive faster and a valuable asset in your organization and anywhere in the fast-growing insurance industry.

Business Owner's Policy (BOP)

In this course we will break the policy down into sections and learn how each works and how they interact with each other to protect construction projects.

Business Auto Policy (BAP/Commercial Auto)

This course covers every section of the ISO Business Auto Policy. Learn this complex contract in an engaging way including multiple chances to answer real-life questions.

Worker Compensation and Employers Liability

Workers' compensation insurance is a type of policy that offers employees compensation for injuries or disabilities sustained as a result of their employment. In this course you will learn about Worker Compensation in general as well as the operation of the ISO Workers Compensation insurance policy form.

Business and Personal Property Policy

The BPP is the natural companion to the Commercial General Liability, or CGL form, since the CGL covers liability only and the BPP covers property losses only.

Here's What Our Students Have To Say

This course was not only a great refresher for some topics, but I also learned some new facts! The interactive, situational questions throughout the course were very helpful and allowed me to apply what I just learned to a real-world type example.

Tom is able to step into the shoes of his audience. His flexible training style helps students better process the material.

Tom really has a knack for making the subject matter easy to understand. I've learned so much from him early in my career that I still use today.

Tom conducts his trainings perfectly. The sequence of the programming and the detail of the courses are straightforward and easy to understand.

Tom's training and mentorship helped propel my career forward. After working with him, I've been able to start my own agency and continue to see growth.

Tom treated students as peers, seeking opportunities to learn from students. This created a warm and inviting dynamic in the room for learning.

Previous

Next

Life Insurance Curriculum

Welcome to the Insurance Industry

In this course you will learn the basics of the insurance industry, how you fit in, some important terminology, and quite a bit about insurance policies in general. This knowledge will make you more productive faster and a valuable asset in your organization and anywhere in the fast-growing insurance industry.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured person and includes both a death benefit and a cash value component.

Universal Life Insurance

Universal life insurance is a type of flexible permanent life insurance policy that allows policyholders to adjust their premiums and death benefit as needed throughout the course of the policy.

Variable Life Insurance

Variable Life insurance is a form of permanent life insurance that allows policyholders to invest part of their premiums in a variety of investment options, such as stocks, bonds, and mutual funds, with the potential for higher returns but also higher risk.

Middle Market/Large Market Commercial Curriculum

Welcome to the Insurance Industry

In this course you will learn the basics of the insurance industry, how you fit in, some important terminology, and quite a bit about insurance policies in general. This knowledge will make you more productive faster and a valuable asset in your organization and anywhere in the fast-growing insurance industry.

Commercial General Liability (CGL/GL)

The Commercial General Liability Policy is the backbone of most business insurance plans. A CGL policy protects a business from financial loss should it be liable for property damage or personal and advertising injury .

Business and Personal Property (BPP/Commercial Property)

The Business and Personal Property policy is also called a Commercial Property Policy. Along with the Commercial General Liability policy, the Business and Personal Property policy is a must have for almost every mid-to large-sized business.

Business Auto Policy (BAP/Commercial Auto)

Commercial Auto Insurance, also known as the Business Auto Policy or BAP, is one of the most often used commercial insurance policies.

Commercial Umbrella and Excess Liability Policies

The Commercial Umbrella/Excess Liability insurance policy supplements liability coverage for businesses. It can be a crucial piece of a commercial risk management plan.

Worker Compensation and Employers Liability

Any business with employees should have a Workers Compensation insurance policy. In fact, it is likely required by state law!

Direct and Officers Liability (Public, Private, Not-for-profit)

Direct and Officers Liability insurance provides protection to individuals and organizations in the public, private, and not-for-profit sectors against claims of mismanagement, negligence, and wrongful acts committed by directors, officers, executives, or employees.

Builders Risk Insurance

Builder’s risk insurance (occasionally referred to as course of construction insurance) is a special type of property insurance that protects buildings under construction and the tools, equipment and materials used in the construction.

Installation Coverage Policy

Installation insurance is a type of inland-marine coverage purchased by construction contractors and subcontractors like HVAC installers, elevator contractors, plumbers and electricians to help protect personal property while work is in progress.

Commercial Crime Insurance

Commercial crime insurance provides protection from financial losses related to business-related crime, including theft by employees, forgery, robbery, and electronic crime.

Contractors Equipment Insurance

Insurance that covers contractors’ equipment is designed to fill the void in coverage that lies between a Business and Personal Property policy and a Commercial Auto policy.

What Makes Re:Form School Training Different

Repetition Based Training

No anxiety-inducing exam at the end. Our courses continually reinforce the learning, randomly incorporating knowledge checks on previously covered topics. You see the important issues multiple times!

Engaging Workbooks

All of the contract courses come with a free, downloadable workbook that enhances your learning and increases your engagement. Effective learning isn't about just staring at a screen!

Real-Life Scenarios

Every course includes real-life scenarios where you put your knowledge to work answering real client questions!

Why Re:Form School?

Flexible purchase options make it easy to tailor education and training for yourself or agents in your agency.

Random Repetitive Training

Re:Form School Insurance Training courses use a proven technique or randomly presenting important material multiple times throughout the course to reinforce both retention and importance.

Easy to Understand Explanations

Re:Form School courses are replete with easy to understand explanations and examples - all in plain English and without industry jargon.

Included Workbooks

Every Re:Form School course includes a workbook matched to the course. Learners complete the workbook as they complete the course. This provides increased engagement, retention, and also serves as a resource for the learner later on!

Get started with the right

option for you.

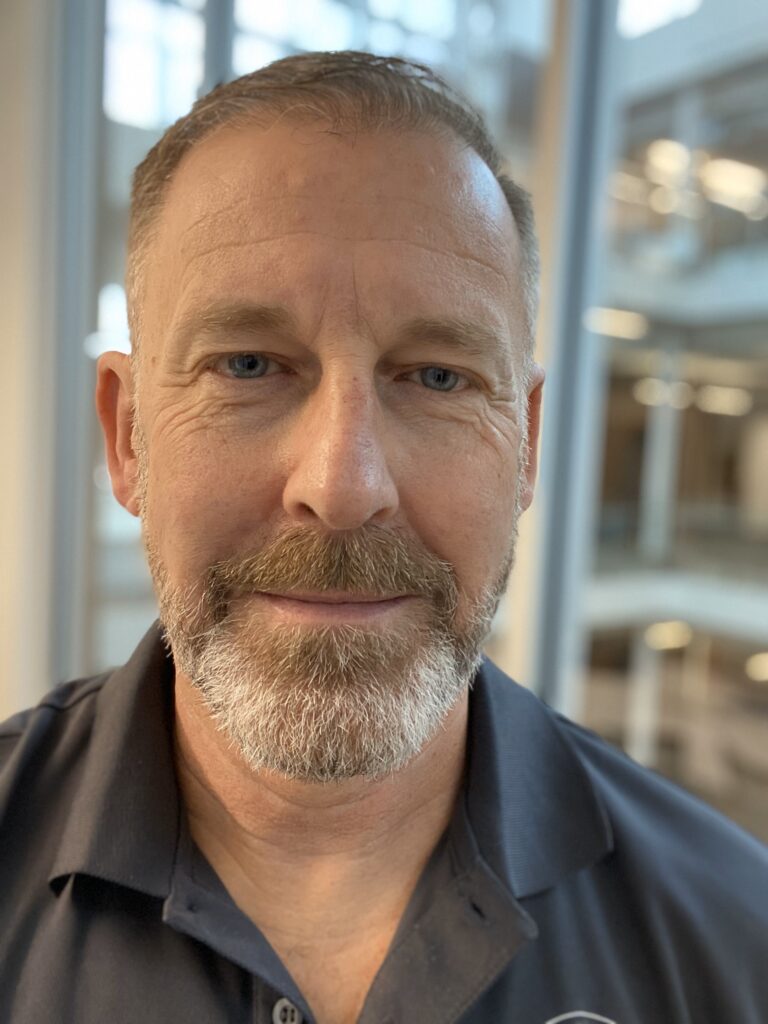

Meet Your Instructor

Tom Faulconer

Tom is an award-winning college instructor, corporate training director and a member of the faculty at Butler University's Davey School of Risk Management and Insurance. He is a licensed attorney and Certified Financial Planner and holds the CPCU, CLU, ChFC, and CASL professional certifications. He teaches at both the undergraduate and graduate levels.

Propel Your Career Today With Re:Form School

Finally, engaging, successful, practical insurance training created by an industry veteran and award-winning risk management professor.